How Much Do You Need To Retire Comfortably?

Over the past few weeks, we have seen online articles regarding the amount required to retire. Unfortunately, when accessing the articles we were prompted to subscribe and pay a monthly subscription fee to read the article. This gave us incentive to write our own version of the article and thoroughly detail what the bare minimums savings amount would be to retire comfortably.

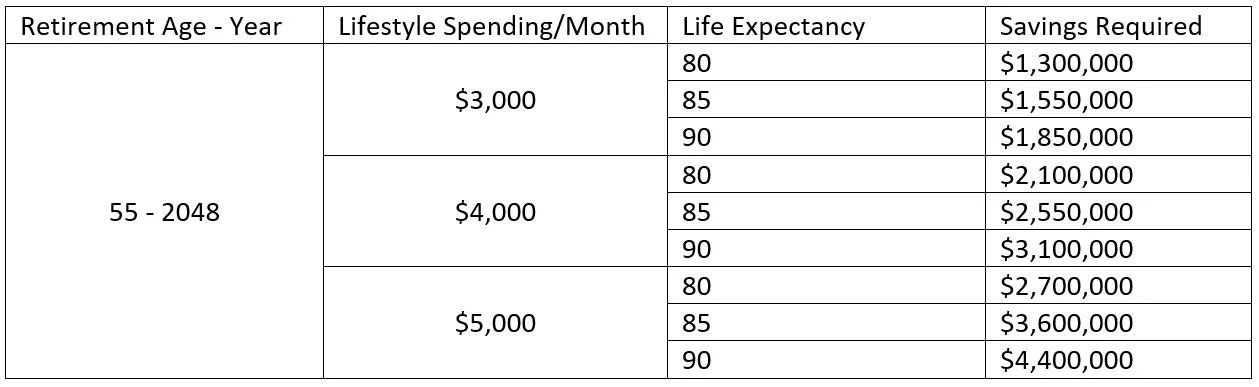

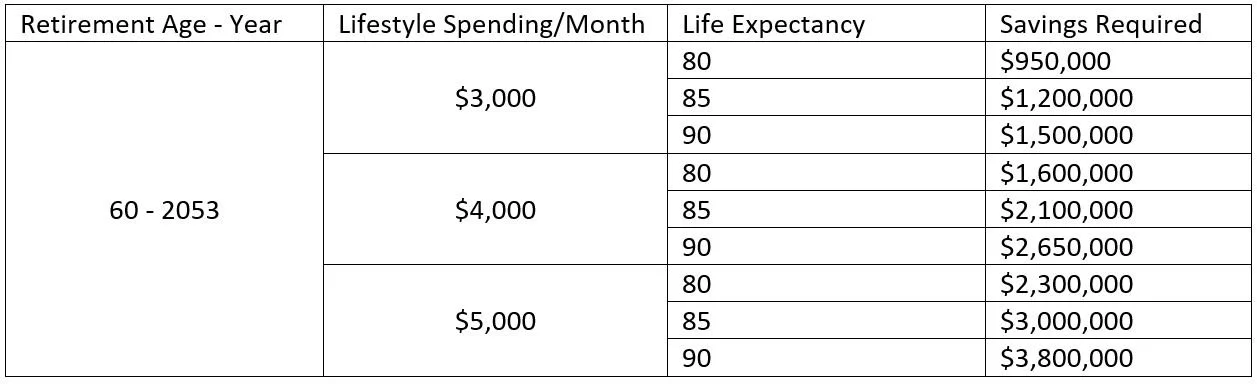

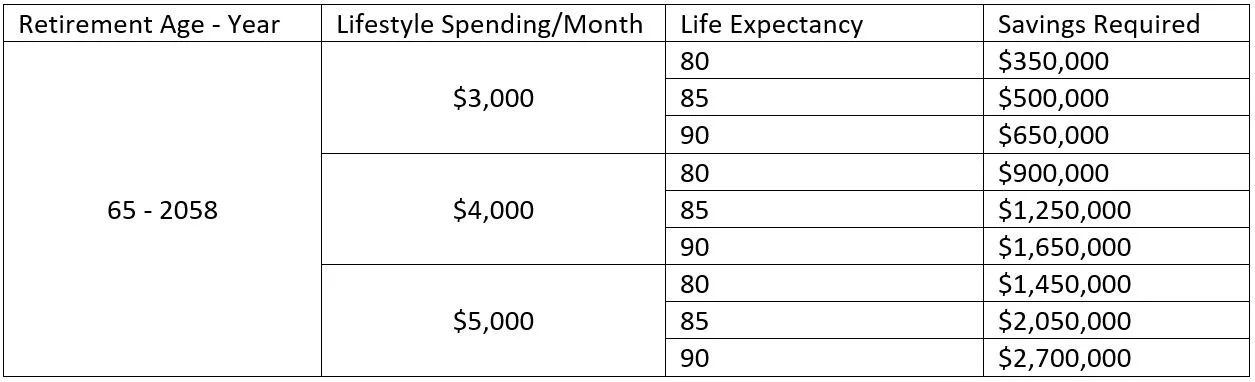

Just like all personal finances, each situation is personal and is different for each individual. Therefore, Construct Your Finances has provided solutions for different retirement ages, retirement lifestyle needs and life expectancy. This article has three (3) tables based on retirement age (55, 60 and 65) along with the associated amount required for retirement. Assumptions are provided at the bottom of this article:

Assumptions:

Individual is 30 years of age in 2023

Annual Inflation Rate = 2.5%

Canadian Pension Plan (CPP) and Old Age Security (OAS) indexed at inflation and withdrawn at age 60 and 65 respectively

Lifestyle spending in the tables are illustrated in today’s dollars

Savings required in the tables are illustrated in future dollars (indexed at inflation)

The individual is not producing income in retirement

Again, this is the bare minimum to achieve the preferred lifestyle spending in retirement. We recommend having a safety net over and above the calculations provided based on unforeseen circumstances in retirement. If there is another scenario you would like Construct Your Finances to calculate, feel free to contact us at 647-684-4945 or email patrick@cyfinances.ca